Looking back on 2018, the global TV panel industry experienced great ups and downs. In the future, the LCD panel industry will face the contradiction between rapid growth in production capacity and slowdown in demand growth for a long period of time, bringing operational challenges caused by panel price fluctuations. According to statistics from Sigmaintell, the number of LCD TV panels shipped worldwide will reach 282 million units in 2018, a substantial increase of 7.4% year-on-year, and the number of shipments has reached a record high. However, due to the rapid downward price, the panel factory is on the verge of profit, and the panel makers face serious challenges. At the beginning of 2019, LCD TV panel prices entered a historical low, manufacturers were deeply troubled by losses, and panel makers could stand in the cruel competition. Sigmaintell believes that the core direction is to enhance cost competitiveness and promote product structure upgrade. And technological innovation.

In fact, the technological innovation in the TV market has been relatively slow in recent years. In 2019, the technology of the TV market still adheres to the trend of “quality and appearance” and is diversified. 4K will become standard; 8K will also usher in the beginning, and the trains that are expected to catch up with 5G technology will leap in the future; OLED TV panels will show diversified development trend, White OLED TVs will accelerate growth; quantum dots, borderless and large-size products will also usher in rapid growth.

TV panel technology development roadmap from 2018 to 2019

Source: Sigmaintell

1. Resolution: start from 8K, seize the high-end market

Improving the image quality has always been the focus of display application development. In the global LCD TV panel market, 4K products have been widely popularized, especially the 4K panels of medium and large size products above 43” have become standard. According to Qunzhi Consulting ( According to Sigmaintell, the global 4K LCD TV panel shipments exceeded 110 million units in 2018, and the penetration rate is close to 40%. In 2019, the penetration rate of global 4K panels will further increase to 47%. With the 4K products Rapid penetration, penetration rate is gradually approaching 50%, and it is expected that the growth rate of 4K product penetration will slow down significantly after 2020.

Vendors are also constantly looking for higher resolution products, and 8K will be the next battleground for panel makers. Subject to the identifiability of human eyes and the positioning of high-end products, 8K products are mainly concentrated in the large-size market of 65” and above, with 65” and 75” as the mainstream configuration. Overseas manufacturers are relatively active in planning for oversized sizes such as 82” and 85”.

Product blueprint of 2019 panel factory 8K LCD TV panel

Source: Sigmaintell

In 2018, Samsung (SDC) 8K panel was officially mass-produced, and the first year of 8K panel was opened. In 2019, Korean, Taiwanese and medium-sized panel manufacturers actively planned 8K products. The 8K panel will be officially launched in 2019 to drive the resolution of LCD panels. The rate achieves another leap. In this year's IFA and other major international exhibitions, mainstream TV brand manufacturers have also exhibited 8K TV products, which is enough to see the brand's layout and determination for 8K products. However, in 2019, the Soc solution is still immature, the product yield is low and the cost is too high. It is expected that the actual volume of shipments will be very limited. According to Sigmaintell's data, it is estimated that the global shipment of 8K panels will be about 300Kpcs in 2019, with a penetration rate of 0.1%. The 8K market is in its infancy. After 2020, with the maturity of production and the decline of cost, as well as the gradual maturity of the brand's active promotion and 5G network, it will drive the 8K panel market to leap forward. According to Sigmaintell, the number of panels for 8K panels will reach 2.6 million units by 2020, and the penetration rate will increase to 1%. By 2022, the penetration rate of 8K panels will further increase to 3.6%. Equipped with a 5G network express, 8K will usher in a leap-forward growth.

2017~2022 global 8K LCD TV panel shipments and penetration trend (unit: million units,%)

Source: Sigmaintell

In addition to the LCD, LGD has a layout for the 8K OLED panel, and released a new 88-inch 8K OLED, which is expected to be available in 2019.

2. QD TV continues to grow at a high speed

In the LCD camp, QD TV uses quantum dot materials in the backlight module, which greatly improves the display color gamut of the TV, and greatly compensates for the natural shortage of LED backlight in the color gamut. The active brand of Samsung Electronics is actively promoting QD products in high-end products; the positive layout of Chinese brands TCL and Hisense has driven the rapid growth of QD TV.

On the supply side of the panel, Samsung (SDC) continues to help upgrade QD products. In 2019, QD Glass will become the mainstream. Compared with the traditional QD Film, the image quality is expected to be further improved and improved, and ultra-thin design can be realized. Increase the sense of quality of the product.

According to Sigmaintell data, the number of QD TV shipments worldwide reached 3.1 million units in 2018, a three-fold increase from 2017. It is estimated that by 2019, global QD TV shipments will maintain rapid growth, and the number of shipments is expected to reach 5.3 million units, and the penetration rate will increase to nearly 2%.

2017~2019 global QD LCD TV shipments and penetration trend (unit: million units,%)

Source: Sigmaintell

3. OLED TV diversified development

1. WRGB OLED TV accelerates penetration

OLED TV panels are still only available exclusively for LMD. Recently, the LCD TV panel business has been affected by the market downturn, prices have continued to decline, and profitability has been seriously challenged. LGD actively seeks business transformation and accelerates the layout of OLED TV panel business. In the second half of 2019, the G8.5 generation OLED panel production line invested in China is about to usher in mass production, driving a significant increase in production capacity. At the same time, LGD's OLED TV panel business began to reverse the previous losses in the second half of 2018, achieving a slight profit, greatly boosting the enthusiasm of the manufacturers. Sigmaintell expects that with the increase in production capacity and continuous improvement in production costs, the global shipment of OLED TV panels will reach 3.7 million units in 2019, and the penetration rate will increase to 1.3%. In the next few years, LGD will continue to increase the supply of OLED TV panels in the strategic direction of large size, including the construction of the G10.5 generation OLED panel production line in Korea. It is not excluded to continue to upgrade the existing G8.5 generation LCD production line. As OLED production capacity, Sigmaintell expects that the global OLED TV market will maintain steady growth in the next few years.

2017~2019 global OLED TV panel shipments trend (unit: million units)

Source: Sigmaintell

2. QD OLED TV is brewing

In addition to the traditional LCD QD TV, Samsung (SDC) is also actively planning QD OLED TV panels, which will achieve substantial technological innovation compared to traditional LCD products. The OLED blue light source of the QD OLED TV panel is supplemented by the red and green QLED of the QD film to form a display effect, which can achieve better image quality and higher color gamut. However, the current QD OLED products are still in the research and development stage, and the electroluminescent QLED materials used in the next-generation display panels have not broken through the scale manufacturing problems. Although SDC already has preliminary capacity planning, the actual mass production is expected to be after 2020. Once the QD OLED panel is in mass production. It is bound to have a profound impact on the global TV industry, while giving consumers a more diverse experience.

QD-OLED product illustration

Source: Sigmaintell

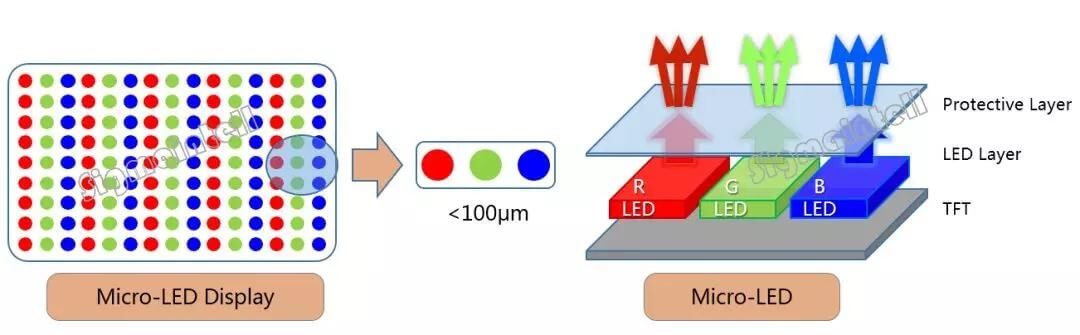

2. Micro LED has a long way to go

Micro LED technology will transfer RGB trichromatic sources to TFT substrates with tiny LED particles of less than 100μm through massive transfer technology to form Micro LED self-luminous displays. It has excellent performance in terms of technology life, contrast, energy consumption, and reaction time. It is the next-generation display technology expected by the industry.

Micro LED product illustration

Source: Sigmaintell

At present, Micro LED is still in the research and development stage, facing the bottleneck of layer technology and production, including epitaxy and wafer, huge transfer, full color, power drive, especially the huge transfer technology is difficult to produce, and the production yield is extremely low. In short, Micro LED still has a long way to go from commercial mass production.

At present, Sony, Samsung Electronics and other international manufacturers have introduced Micro LED related concept products. Sony's CLEDIS display exhibited at 2017CEC is spliced with 144 Micro LEDs; Samsung Electronics exhibited globally at 2018 CES The first modular 146-inch Micro LED TV “The Wall” is mainly used in cinema scenes. In the large-size market, Micro LED will mainly be based on high-end commercial large-size display screens, which are mainly used in cinema projection scene applications. Applications in the consumer electronics market, such as television, will take at least three years.

4. The pursuit of the ultimate

Consumers' pursuit of appearance is even more extreme, and manufacturers are trying their best to provide a more refined design, which is nothing more than a thinner product, a narrower border, and a larger size. Sigmaintell believes that in 2019, no borders became mainstream, and large-size products exploded.

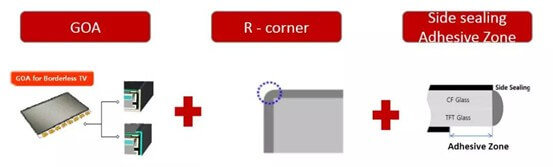

1. Three sides without borders become mainstream products

With the continuous improvement of the appearance requirements of consumers, manufacturers have spent a lot of time on the design of the frame, the frame is getting narrower and narrower, and almost the full-screen display has also greatly improved the high-level feeling of the TV.

For panel manufacturers, the GOA process, the R-angle design, and the Side sealing are required to produce a frameless panel. As the yield of GOA has been effectively improved, the supply of products with no borders has increased substantially, and it has gradually become the mainstream configuration in the market.

Borderless panel product process diagram

Source: Sigmaintell

The borderless products are dominated by Korean factories, and manufacturers in Taiwan and mainland China are actively planning. At present, mainstream Korean and Taiwanese manufacturers have mass-produced products with no borders, and Korean manufacturers are further promoting four-sided borderless products. Mass production.

From the perspective of the brand, the domestic brand aims to realize the standardization of the whole frame without borders; the Korean system basically realizes the three-sided borderless design in the high-end models. At present, some new products appear on the four sides without borders, and it is foreseen that there will be no borders. Will become one of the next TV standard.

2. Large-size products accelerate growth

Sigmaintell believes that large-size panels of 65” and above in 2019 will accelerate growth for three reasons:

First of all, the gradual release of G10.5 line capacity will form an effective guarantee for large-size panel supply of 65” and above. In 2019, BOE's world's first G10.5 is full of production, while CSOT and Sharp's G10.5 are both. Mass production will continue to increase, and the capacity supply of oversized 65” and above will increase by more than 50% year-on-year.

Secondly, with the decline in the price of large-size panels, the sales price of large-size TVs in the terminal market has also ushered in a large adjustment, and gradually entered the sweet price acceptable to consumers, stimulating sales to increase substantially.

Thirdly, the rapid growth of terminal applications such as Shangxian, represented by IWB, has driven the market demand for large size, especially 65”+ super-size, to grow steadily.

According to Sigmaintell's forecast data, the number of 65" panel shipments reached 19 million in 2019, a significant increase of 29% year-on-year, accounting for 7% of the global TV panel market. The oversized demand of 65" or more will reach 6.7 million units, an increase of 31% year-on-year, the market share increased to 2.5%, and the proportion of large size 65" and above will be close to 10%.

2017~2019 Global 65" and above large-size panel shipments (unit: million units)

Source: Sigmaintell

The surface TV products actively promoted by the previous manufacturers, due to the change of brand strategy and the decline of consumer heat, the penetration rate of curved TV shows a rapid decline. At present, in addition to the TCL brand in the Chinese market, the TCL brand is still relatively active. Other brands have almost no plans for new products for curved products, and the strategy is conservative.

UIV OLED would follow the development of the industry and contribute to the development of the industry.

Company name: YURUI (SHANGHAI) CHEMICAL CO., LTD

ADD: Floor 5, Building H2, No.3188 Xiupu Rd, Pudong, Shanghai, China.

Web: www.riyngroup.com Email: Info@riyngroup.com

Tel: (0086)21-50456736 FAX: (0086)21-50761379